Hey, !

Welcome back to AI Accounting Daily.

Presented By

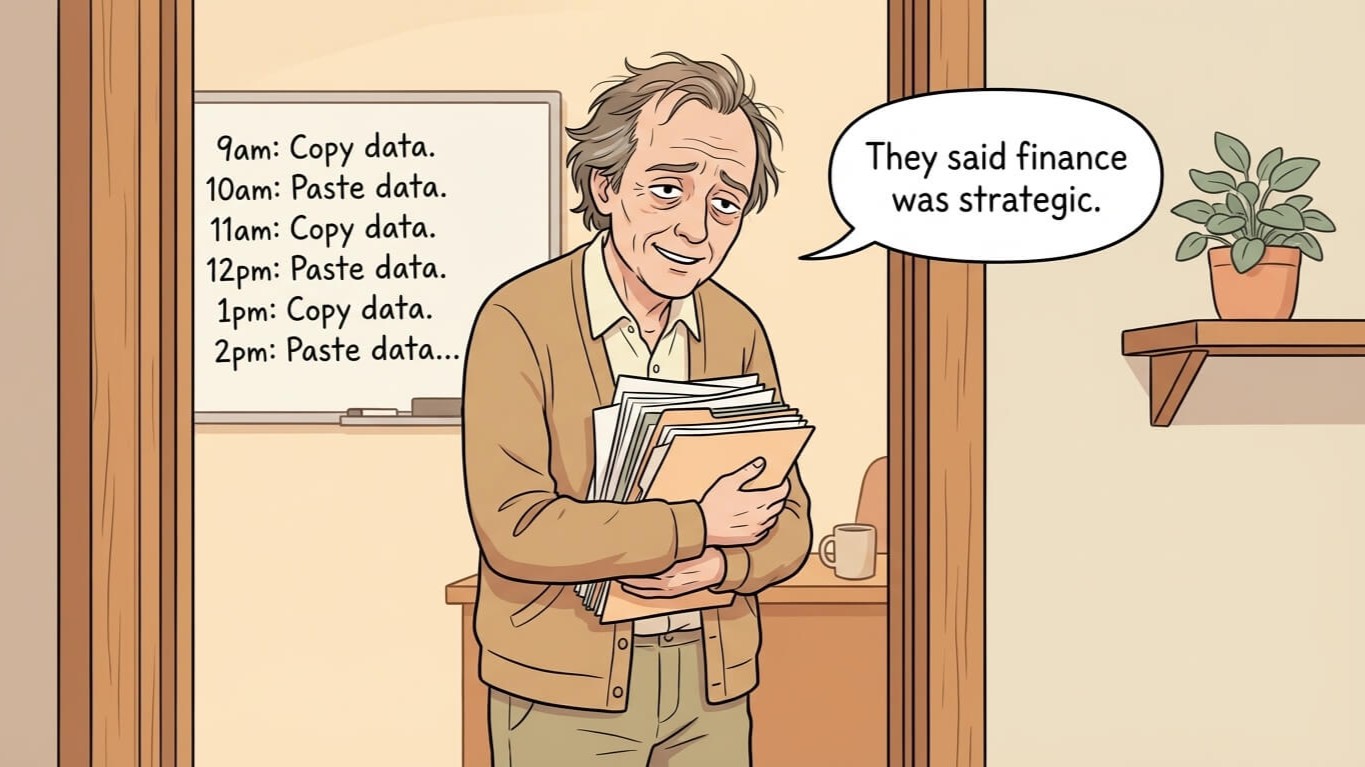

I'm not faster. I just stopped doing admin.

Everyone kept saying I needed to be more efficient. Work smarter. Use shortcuts.

Meanwhile, I was entering the same invoice data into NetSuite, then the spreadsheet, then the approval form.

Copy. Paste. Repeat. Forty times a week.

That's not finance. That's data entry with a fancier title.

I switched to airSlate WorkFlow. Now the bots pull data from the CRM, populate the docs, and push updates back, automatically. No copy/paste. No dual entry.

My "productivity gain" was just eliminating work that shouldn't have existed.

Stop doing admin. Use airSlate WorkFlow.

Latest in Accounting AI

Xero's AI Gives Small Biz Big-League Analytics

Canopy's AI Tax Prep: No More Handoffs, Just Speed

AI Applications

1. 🤝 Lawpath simplifies legal compliance by providing on-demand attorney-verified contracts and automated document creation, allowing firm owners to protect their business and clients without expensive hourly legal fees.

2. ⚡ Vida manages 24/7 AI call answering and automated appointment scheduling so firm owners stop missing inquiries and free staff from repetitive administrative phone work.

3. 🤝 Reply.io automates email outreach and follow-ups so accounting firms nurture leads, schedule consultations, and grow their pipeline without manual CRM chasing.

4. ⚡ Social Champ streamlines multi-platform social media scheduling and client proofing so accounting firms maintain a professional online presence that attracts high-margin advisory prospects.

5. ⚡ leadpages generates high-converting landing pages with lead enrichment and A/B testing, helping firms build a predictable pipeline of high-quality advisory clients beyond referrals.

6. 🧾 Navan streamlines expense management from swipe to reconciliation, providing real-time visibility and integrating key data with the ERP to save hours on the monthly close.

7. 📊 Kick automates your bookkeeping workflows so your firm standardises data, reduces manual reconciliation and unlocks more capacity for high-margin advisory services.