Hey, !

Welcome back to AI Accounting Daily.

Presented By

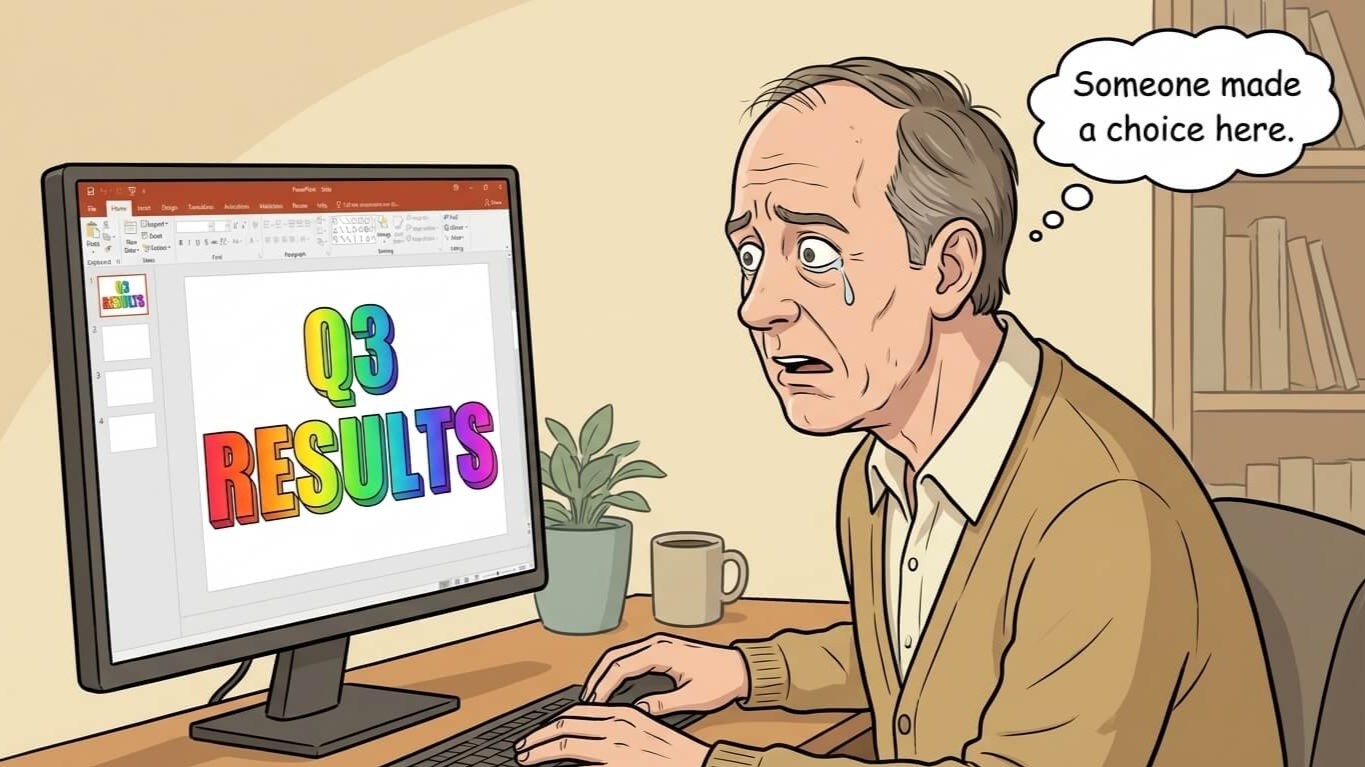

I inherited a 47-slide deck from 2019. Fixed it in 90 seconds.

The fonts were wrong. The colors were wrong. Half the images were broken.

Someone had used WordArt. WordArt. I'd been dreading this thing for a week.

That's not work. That's archaeology.

So I dropped it into Gamma.

One click. New theme. Clean layouts.

Everything aligned. Ninety seconds later, it looked like I made it myself.

I didn't redesign 47 slides. I didn't touch a single text box. I just stopped doing it the old way.

Try Gamma. Let the dead decks rest.

Latest in Accounting AI

RSM's 'Ask Luca' AI Speeds Up Audits—Instant Insights!

Mercans' AI Just Made Payroll a Game Changer

AI Applications

1. ⚡ Tradify streamlines quoting, scheduling, invoicing and job‑tracking so your firm supports trade‑clients with efficient workflows, reduces manual entry and improves profitability.

2. 🧾 Dext captures and categorizes receipts automatically, eliminating manual entry and enabling firms to reconcile accounts faster while freeing time for advisory services.

3. ⚡ Synthesia scales client education and internal training by generating secure, multilingual AI videos, drastically reducing the firm's time spent on repetitive explanations and staff onboarding.

4. ⚡ Browse AI automates web data collection so accounting firms track client updates, competitor pricing, or compliance changes without manual research or spreadsheet maintenance.

5. 📈 Qoyod automates accounting and invoicing workflows, minimizing Excel-QuickBooks conflicts and providing real-time client insights to enhance efficiency and profitability.

6. 🤝 Lusha enriches contact data automatically so accounting firms build verified prospect lists, streamline outbound outreach, and grow their client base with accurate insights.

7. 📊 Jenesys deploys an AI accounting co-pilot that automates transaction coding and reconciliations so your firm reduces partner review time, mitigates errors and boosts client profitability.