Presented By

I documented 47 processes while eating a sandwich.

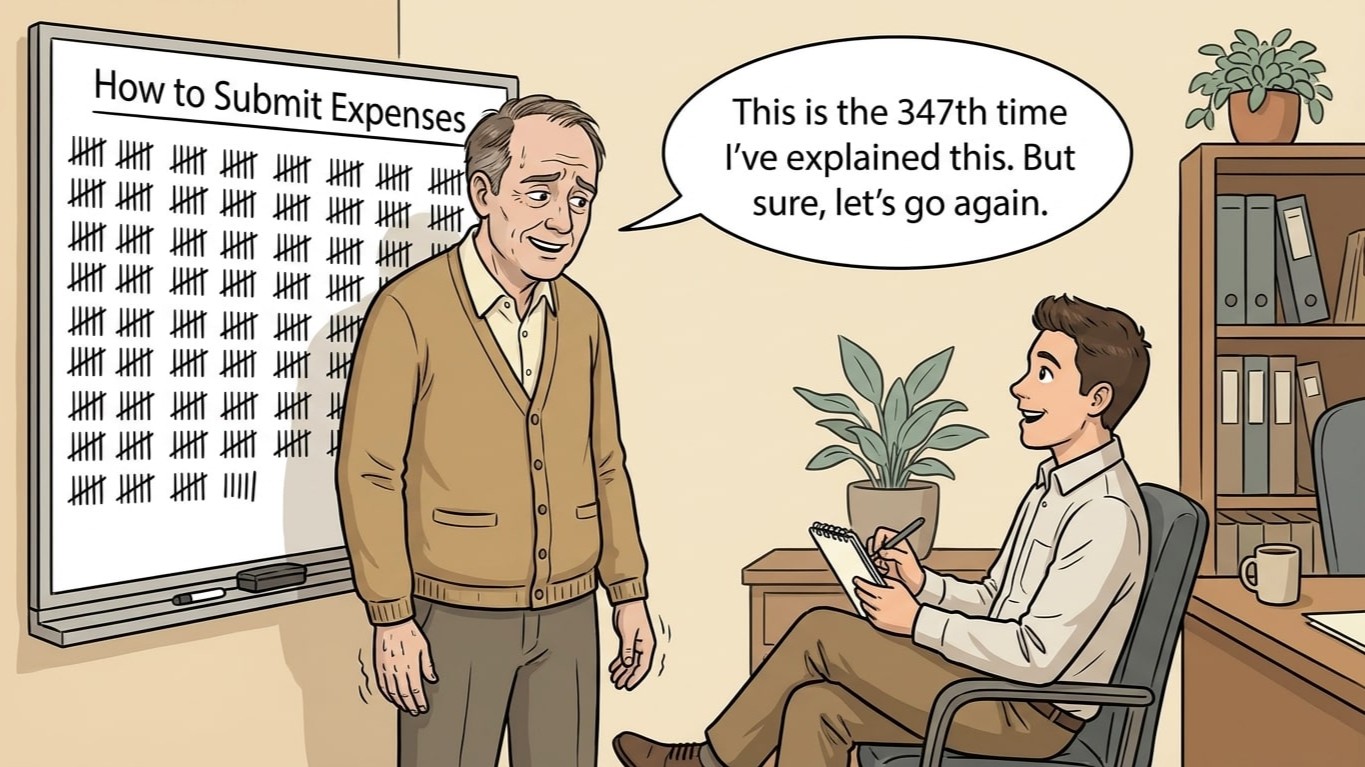

I'd been putting it off for two years. The processes were in my head, in random Google Docs, in Slack threads I couldn't find. Every new hire meant re-explaining everything from scratch. Again.

I knew I should document. I just didn't have three months to write a novel about how we do things.

That's not a character flaw. That's a tool problem.

So I tried Trainual. Typed a few bullet points. Hit "Compose."

The AI wrote the whole SOP for me. Formatted. Ready to assign. 47 processes documented. Lunch break. Sandwich intact.

Now my team finds answers without asking me. New hires onboard themselves.

I stopped being the walking Wikipedia of this company.

Try Trainual. Take your lunch back.

Latest in Accounting AI

AI Wants Your Data Entry. Take It, Please.

How AI Founders Make Bad Margins Look Good

AI Applications

1. 🤝 Dealfront automates website visitor identification and lead enrichment so firm owners identify high-intent prospects, build a predictable sales pipeline, and grow advisory revenue.

2. 🤝 zoominfo prioritizes ideal client segments and buyer intent data so accounting firms can build a predictable pipeline and profitably grow their advisory services.

3. 🤝 Softr builds secure, no-code client portals and live dashboards to automate client document collection, eliminating version chaos and freeing capacity for advisory.

4. 🧾 Shoeboxed automates receipt scanning and expense categorization so accounting firms eliminate manual data entry, reduce errors, and gain accurate, auditable client expense records.

5. ⚡ AskYourPDF turns static client documents into interactive chats so your team extracts insights, curbs manual review time and delivers advisory-ready summaries to clients faster.

6. ⚡ Descript automates audio and video editing so your firm produces client updates, training, and webinars efficiently, reducing production time while maintaining professional-quality content.

7. ⚡ Windsor ai consolidates cross-channel data into live dashboards so firm owners eliminate manual Excel reconciliation and provide clients with proactive, data-backed advisory insights.