Presented By

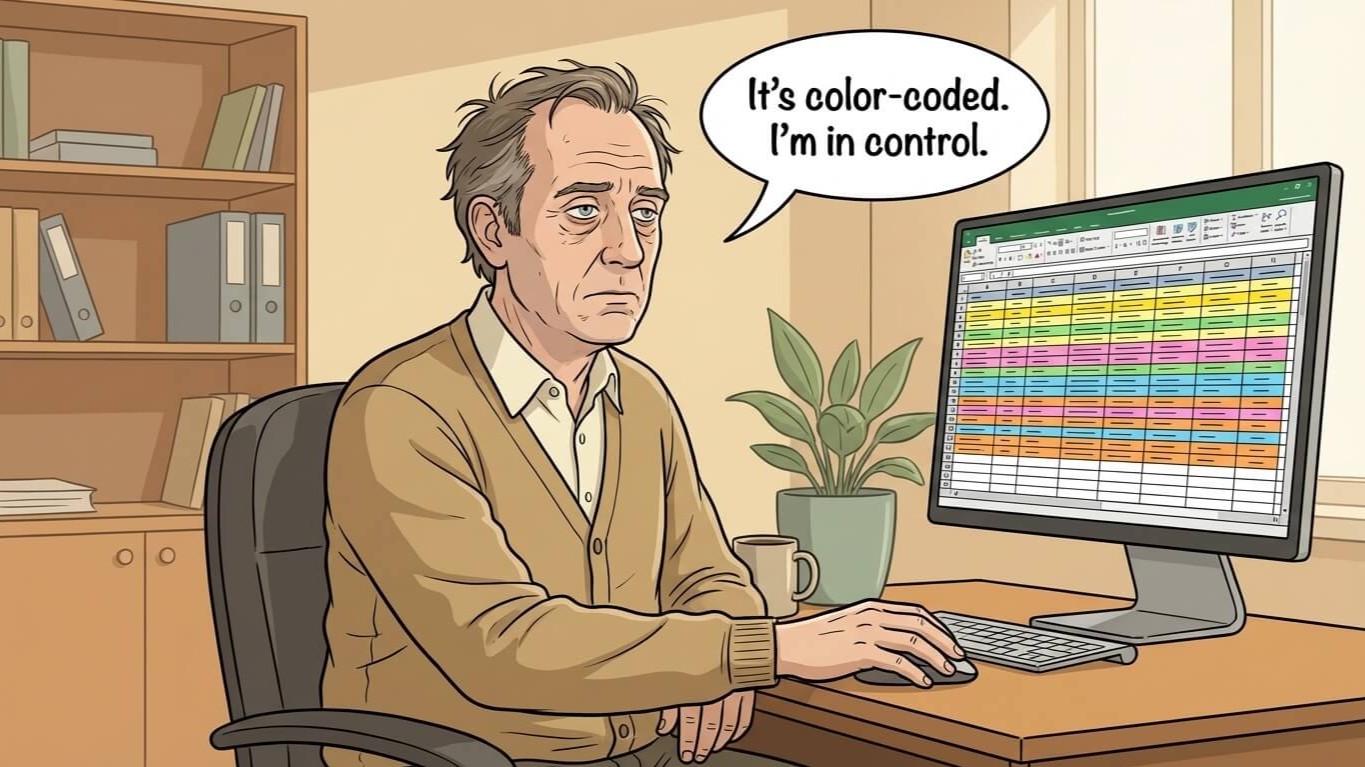

I love spreadsheets. (I'm lying.)

I used to tell people I was "good with Excel."

Translation: I spent half my week copying data between tabs, color-coding rows like a maniac, and praying nobody asked for a filter I couldn't build.

That's not a skill. That's a coping mechanism.

Then I found Softr. Took my messy Google Sheet.

Turned it into an actual app with a real interface. Took an hour. No code.

Now clients log in and see their data. Clean. Professional. I look like I know what I'm doing.

Use Softr. Retire the spreadsheet. You've suffered enough.

Latest in Accounting AI

Everyone's Buying Nvidia. The Smart Money's on Taiwan Semi.

Cuban to New Grads: Skip Big Tech. Small Firms Need You More.

AI Applications

1. ⚡ Tradify streamlines quoting, scheduling, invoicing and job‑tracking so your firm supports trade‑clients with efficient workflows, reduces manual entry and improves profitability.

2. 🧾 Dext captures and categorizes receipts automatically, eliminating manual entry and enabling firms to reconcile accounts faster while freeing time for advisory services.

3. ⚡ Synthesia scales client education and internal training by generating secure, multilingual AI videos, drastically reducing the firm's time spent on repetitive explanations and staff onboarding.

4. ⚡ Laxis transcribes and summarizes meetings so accounting teams track client conversations accurately, reduce follow-up time, and improve communication clarity across the firm.

5. 📈 Qoyod automates accounting and invoicing workflows, minimizing Excel-QuickBooks conflicts and providing real-time client insights to enhance efficiency and profitability.

6. 🤝 Lusha enriches contact data automatically so accounting firms build verified prospect lists, streamline outbound outreach, and grow their client base with accurate insights.

7. 🧾 ScanRelief automates receipt-and-invoice filename cleanup and Excel conversion so your firm eliminates document chaos, reduces manual entry errors and accelerates client close cycles.