Latest in Accounting AI

Intuit AI Lifts QuickBooks Revenue 20 Percent

Agora Automates Client Inquiries And Email Triage

AI Applications

1. 💰 Hedy automates payroll education and compliance tracking so accounting firms support clients with clear guidance, reduce liability risks, and strengthen HR advisory services.

2. 👥 Skillfully assesses candidate skills via real‑world simulations so your firm hires smarter, lowers training time and builds a more capable junior team for advisory services.

3. 📊 Jupid automates LLC formation, bookkeeping and tax-filing workflows so your firm adds compliant services, reduces admin overhead and scales advisory revenue without hiring extra staff.

4. 📈 Demodesk streamlines client meetings by automating scheduling and screen-sharing workflows so accountants save prep time, improve collaboration, and enhance client satisfaction.

5. ⚡ ReceiptsAI scans, categorizes, and extracts receipt data using AI so your firm eliminates manual entry, ensures accuracy, and speeds up bookkeeping processes.

6. 🤝 PracticeProtect combines human expertise with AI-supported cybersecurity to protect client data, ensuring compliance, reducing risk, and safeguarding firm reputation.

Updates in AI

Google Reinvents Search To Counter OpenAI

OpenAI Adds Group Chats To ChatGPT

Billtrust Finds Finance Leaders Fear AI Fraud

Prompt Ideas

Draft Emails Explaining Missing Items in Books

Presented By

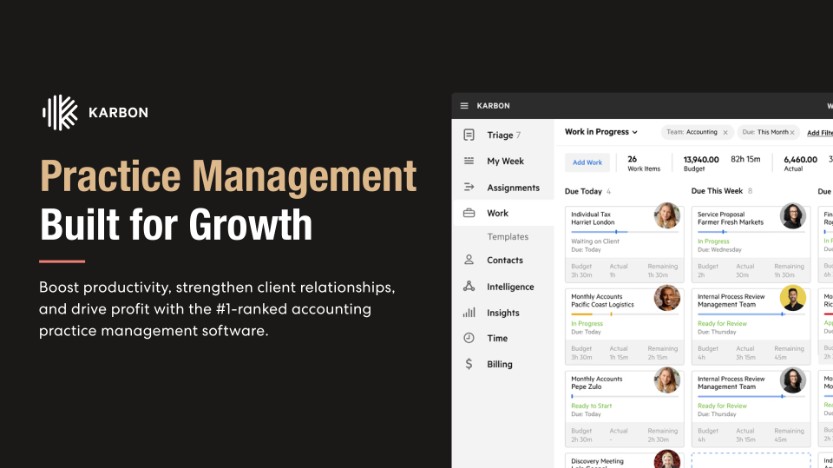

Karbon: The AI practice management platform built for accounting firms.

Streamline your firm’s work with AI that automates tasks, manages projects, and keeps your team aligned — all in one platform.

• Workflow automation reduces repetitive, low-value tasks

• Project & task management keeps every job on track with complete visibility

• Email & team collaboration centralizes communication and simplifies coordination

• Client management & portal securely manages relationships and shares sensitive information

Trusted by accounting firms saving 18.5 hours per employee per week.

See how Karbon helps firms work smarter →