Latest in Accounting AI

Principal Financial Adds AI Training To Onboarding

Agentic AI Adds Four Accounting Use Cases

AI Applications

1. 💰 Hedy automates payroll education and compliance tracking so accounting firms support clients with clear guidance, reduce liability risks, and strengthen HR advisory services.

2. 👥 Workday Adaptive Planning uses AI to surface insights, automate headcount reconciliation and run scenario-based forecasts so your firm models with speed and accuracy.

3. 📊 TaxDome leverages AI for faster document handling and analytics, streamlining client workflows, reducing manual follow-up, and enabling accountants to focus on advisory services.

4. 📈 Ottimate automates AP with AI that learns to scan invoices at 98% accuracy and detects spend anomalies so your firm reduces errors and boosts efficiency.

5. ⚡ Guidde turns workflows into step-by-step video guides so accountants document processes faster, train staff consistently, and reduce onboarding time across the firm.

6. 🤝 EY Taxmann.AI applies AI to research, analyze documents, and generate responses so your firm enhances accuracy, saves time, and improves client advisory efficiency.

Updates in AI

Study Finds AI Hiring Amplifies Bias And Autonomy Harms

CFP Board Urges Client-Facing AI Shift

Meta AI Reviews May Penalize Women

Prompt Ideas

Summarize Industry-Specific Accounting Rule Changes

Presented By

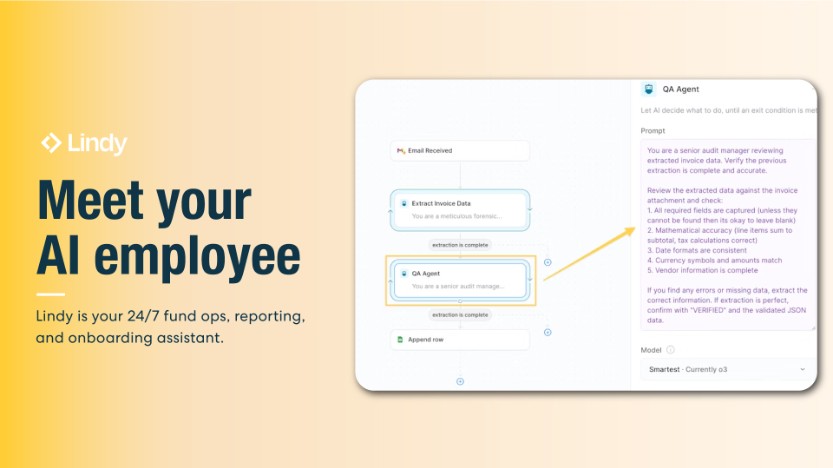

Meet Lindy.ai - Your First AI Employee, Built to Scale

Lindy is a no-code platform that lets you build, deploy, and manage AI agents to handle real business tasks across your organization.

Your workflows, powered by Lindy:

• AI prospecting finds, scores, and engages leads automatically

• AI sales agent qualifies prospects and books meetings for you

• AI email automation drafts replies and sequences follow-ups

• AI Workflow Builder creates no-code, AI-driven workflows

Trusted by teams scaling faster without adding headcount.